As Shop Car Insurance Quotes: The Role of Driving History in Australia takes center stage, this opening passage beckons readers with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Driving history in Australia encompasses various aspects that significantly impact car insurance quotes. Understanding these factors is crucial for making informed decisions regarding insurance coverage.

Understanding Driving History in Australia

Driving history in Australia refers to a record of an individual's past driving behavior and experiences on the road. This information is crucial for insurance companies when determining the risk associated with insuring a driver.

Types of Information in a Driving History Report

- License status: This includes details about the driver's license, such as whether it is valid, suspended, or revoked.

- Traffic violations: Any traffic tickets or citations received by the driver will be recorded in the driving history report.

- Accident history: Information about past accidents, including fault determination and severity of damages, is included in the report.

- Demerit points: Accumulated demerit points from traffic offenses are also part of the driving history report.

Impact of Driving History on Car Insurance Quotes in Australia

Having a clean driving history with no accidents or traffic violations can result in lower car insurance premiums, as it indicates a lower risk of future claims. On the other hand, a history of accidents and traffic offenses may lead to higher insurance rates due to the increased likelihood of filing claims.

Insurers use driving history as a key factor in assessing the level of risk posed by a driver and determining the cost of insurance coverage.

Importance of Driving Record in Determining Insurance Premiums

Having a clean driving record can significantly impact the amount you pay for car insurance. Insurance companies use your driving history to assess your risk level as a driver, which in turn determines your insurance premiums.

Effect of Clean Driving Record on Insurance Premiums

- Drivers with a clean record, meaning no traffic violations or accidents, are considered to be low-risk by insurance companies.

- As a result, these drivers are often rewarded with lower insurance premiums compared to those with a history of violations or accidents.

- Being a safe and responsible driver can lead to substantial savings on your insurance costs over time.

Impact of Traffic Violations and Accidents on Insurance Costs

- Instances of speeding tickets, DUIs, at-fault accidents, or other violations can cause your insurance premiums to increase.

- Insurance companies view drivers with a history of violations as higher risk, leading to higher premiums to offset that risk.

- Repeated violations or severe accidents can result in even steeper rate hikes or potential loss of coverage.

Examples of Specific Driving Incidents and Insurance Rates

- For example, a DUI conviction can cause your insurance premiums to double or even triple in some cases.

- Being involved in a at-fault accident may result in a noticeable increase in your insurance rates for several years.

- Speeding tickets or other minor violations can also lead to incremental increases in your premiums over time.

Factors Considered in Assessing Driving History

When assessing driving history, insurance companies take into account various key factors that can impact insurance premiums

Frequency of Claims

- The frequency of claims made by a driver is a crucial factor considered by insurers. Drivers who have a history of making frequent claims are seen as higher risk and may face higher insurance premiums.

- Drivers with a record of multiple claims are more likely to continue making claims in the future, which increases the likelihood of the insurer having to pay out money for damages.

Demerit Points and License Suspensions

- Demerit points accumulated from traffic offenses can impact insurance premiums. Drivers with a high number of demerit points are viewed as higher risk and may face increased premiums.

- License suspensions due to serious traffic violations can also have a significant impact on insurance premiums. Insurers consider license suspensions as a sign of risky driving behavior.

- Drivers with a history of license suspensions are likely to face higher insurance premiums due to the increased risk associated with insuring them.

Comparing Insurance Quotes Based on Driving History

When it comes to comparing insurance quotes based on driving history, it's important to understand how different providers assess your record. This can have a significant impact on the premiums you are quoted. By analyzing the driving history criteria used by various insurers, you can make an informed decision on the best deal for your specific circumstances.

How Driving History Affects Insurance Quotes

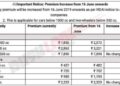

| Driving History | Insurance Provider A | Insurance Provider B | Insurance Provider C |

|---|---|---|---|

| Clean record | Low premium | Medium premium | Low premium |

| One minor violation | Medium premium | High premium | High premium |

| Multiple violations | High premium | High premium | Very high premium |

Examples of Premium Variations

For example, a driver with a clean record may be offered a premium of $800 by Provider A, while Provider B might quote $1200 due to a minor violation on the record.

Strategies for Finding the Best Deal

- Compare quotes from multiple insurers to see who offers the best rates based on your driving history.

- Consider bundling your auto insurance with other policies to potentially qualify for discounts.

- Look for insurers that offer safe driving rewards programs to help lower your premiums over time.

- Be upfront about any past violations or accidents to ensure you receive accurate quotes.

Closing Summary

In conclusion, the role of driving history in Australia when shopping for car insurance quotes is undeniable. By considering the impact of one's driving record on insurance premiums, individuals can make more informed choices to secure the best deals available.

FAQ Section

What constitutes driving history in Australia?

Driving history in Australia includes details such as traffic violations, accidents, demerit points, and license suspensions.

How does a clean driving record impact insurance premiums?

A clean driving record can lead to lower insurance premiums as it indicates a lower risk of accidents or claims.

What key factors do insurers consider when evaluating driving history?

Insurers consider factors like the frequency of claims, traffic violations, accidents, demerit points, and license suspensions.

How can driving history affect insurance quotes from different providers?

Different providers may offer varying insurance quotes based on an individual's driving history, highlighting the importance of comparing options.