Beginning with Auto Policy Quotes: Understanding Comprehensive vs Third-Party in UAE, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

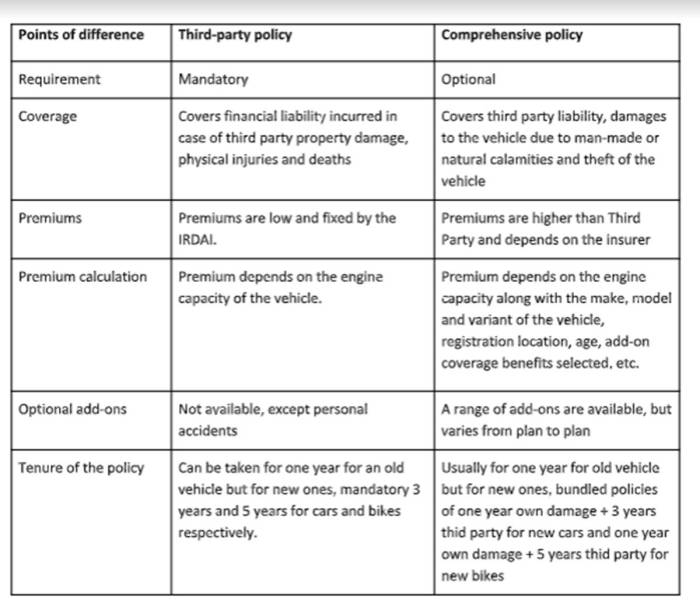

When it comes to auto insurance in the UAE, understanding the differences between comprehensive and third-party coverage is crucial for making informed decisions. Let's delve into the intricacies of these two types of policies to help you navigate the world of insurance with confidence.

Understanding Auto Policy Quotes

When looking at auto policy quotes in the UAE, it's important to understand the two main types of coverage: comprehensive and third-party.

Comprehensive Coverage

Comprehensive coverage in UAE auto insurance provides protection for your own vehicle in case of accidents, theft, fire, or other damages. It offers a wide range of coverage and is generally more expensive than third-party coverage.

Third-Party Coverage

On the other hand, third-party coverage in UAE auto insurance only covers damages and injuries to third parties involved in an accident where you are at fault. It does not cover any damages to your own vehicle.

Comparison

- Comprehensive coverage offers broader protection for your vehicle, including damages from natural disasters, vandalism, and theft, while third-party coverage only covers damages to others.

- Comprehensive coverage is more expensive but provides more peace of mind, while third-party coverage is more budget-friendly but offers limited protection.

- Comprehensive coverage may include additional benefits like roadside assistance and agency repairs, which are not typically included in third-party coverage.

Factors Influencing Insurance Premiums

When it comes to auto insurance premiums, there are several factors that can influence the cost of coverage. These factors can vary depending on whether you opt for comprehensive or third-party coverage.

Comprehensive Coverage

Factors that affect premium costs for comprehensive coverage may include:

- The value of the car being insured

- The driver's age, driving experience, and record

- The location where the car is primarily parked

- The deductible amount chosen by the policyholder

- The extent of coverage and additional benefits included in the policy

Third-Party Coverage

On the other hand, the factors that affect premium costs for third-party coverage differ slightly:

- The make and model of the car being insured

- The driver's age and driving experience

- The geographical area where the car is primarily driven

- The limits of liability coverage selected by the policyholder

- Any additional riders or coverage options added to the policy

For example, a young driver with a sports car may pay higher premiums for comprehensive coverage compared to an older driver with a sedan. Similarly, a policyholder residing in a high-crime area may face increased rates for third-party coverage due to the heightened risk of theft or vandalism.

Coverage Limits and Exclusions

When it comes to auto insurance policies in the UAE, it is essential to understand the coverage limits and exclusions to ensure you are adequately protected in case of an accident or unforeseen event. Let's dive into the details of coverage limits and exclusions for both comprehensive and third-party insurance.

Comprehensive Auto Insurance

Comprehensive auto insurance provides extensive coverage for a wide range of scenarios, offering peace of mind to policyholders. Here are the key points regarding coverage limits and exclusions under comprehensive auto insurance:

- Comprehensive coverage typically includes protection against damages caused by accidents, theft, vandalism, natural disasters, and other non-collision incidents.

- Policyholders can select the coverage limits based on the value of their vehicle and personal preferences.

- Common exclusions under comprehensive insurance may involve wear and tear, mechanical breakdown, and intentional damage.

- It is crucial to review the policy details to understand specific exclusions that may apply to your comprehensive coverage.

Third-Party Auto Insurance

On the other hand, third-party auto insurance offers basic coverage mandated by law, focusing on liability protection for damages caused to third parties. Here are the coverage limits and exclusions typically associated with third-party insurance:

- Third-party insurance covers bodily injury or property damage caused to others in an accident where the policyholder is at fault.

- Coverage limits under third-party insurance are predetermined by regulatory authorities and may vary based on the policy terms.

- Exclusions under third-party insurance often include damages to the policyholder's vehicle or personal injuries, requiring additional coverage for comprehensive protection.

- It is important to understand the limitations of third-party insurance and consider additional coverage options to ensure comprehensive protection for your vehicle and yourself.

Claims Process and Customer Support

When it comes to auto insurance policies in the UAE, understanding the claims process and customer support services is essential for a smooth experience in case of an unfortunate event.

Comprehensive Coverage Claims Process

- After an accident or damage to your vehicle, contact your insurance provider immediately to report the incident.

- Provide all necessary documentation, such as the police report, photos of the damage, and any other relevant information requested by the insurer.

- Your insurance company will then assess the damage and provide you with an estimate for repairs or replacement.

- Once the claim is approved, you can proceed with the repairs at a network garage or workshop authorized by your insurance provider.

- Upon completion of repairs, submit the final invoices and documentation to your insurer for reimbursement or direct settlement.

Customer Support for Comprehensive Policies

- Insurance providers offering comprehensive coverage typically have dedicated customer support teams available 24/7 to assist you with any queries or claims.

- You can reach out to customer support via phone, email, or mobile apps for quick assistance and guidance throughout the claims process.

- Some insurers may also offer additional services such as roadside assistance, towing, and emergency support for added convenience.

Third-Party Coverage Claims Process and Customer Support

- For third-party coverage, the claims process is usually simpler as it only involves claims for damages caused to the other party involved in an accident.

- You will need to report the incident to your insurance provider, who will then handle the claim on your behalf and communicate with the affected party's insurer.

- Customer support for third-party coverage may be more limited compared to comprehensive policies, as the focus is primarily on handling third-party claims.

Outcome Summary

As we conclude our discussion on Auto Policy Quotes: Understanding Comprehensive vs Third-Party in UAE, it becomes evident that having a clear grasp of the nuances between these coverage options can significantly impact your insurance choices. Whether you opt for comprehensive coverage for maximum protection or third-party coverage for budget-friendly options, being well-informed is the first step towards securing the right policy for your needs.

Frequently Asked Questions

What is the coverage limit under comprehensive auto insurance?

The coverage limit under comprehensive auto insurance typically depends on the value of your vehicle and the policy you choose. It usually covers damages up to a certain amount specified in the policy.

Are there any common exclusions in comprehensive policies?

Common exclusions in comprehensive policies may include wear and tear, mechanical breakdowns, and intentional damage caused by the policyholder. It's essential to review your policy to understand what is not covered.

How does the claims process differ between comprehensive and third-party coverage?

The claims process for comprehensive coverage is typically more extensive and may involve detailed inspections and documentation compared to third-party coverage. Additionally, customer support services for comprehensive policies tend to be more comprehensive.